Cyber insurance: Because the costs of investigating and responding to cyber attacks can be staggering for small firms, some companies are turning to cyber liability insurance. If your business stores data in the cloud, I would certainly look into purchasing. FYI, my friend Chad Ezkanazy over at Morstan General Agency Insurance can help you out.

Texas Bill to Allow Service of Process Via Facebook. Bradley Shir, an attorney based in Washington, DC. reports that Texas recently introduced a bill that would allow for service of process via Facebook. Texas House Bill 1989 if enacted would make the Lone Star State the first in the United States to allow for service of process via social media as an alternative means of service. No word if New York plans to allow service of process by Facebook anytime soon.

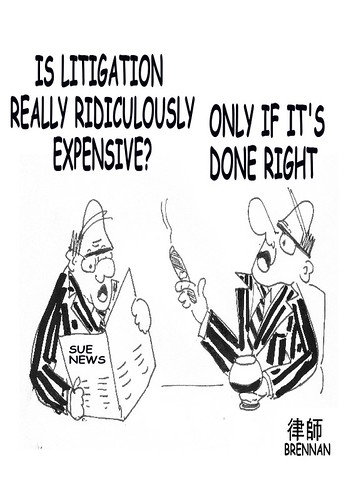

To Place Graduates, the New York Times reports that Law Schools Are Opening Firms. It is hard to believe that it has come to this. We all know that law schools have been running a scam for decades. With relatively low overhead law schools are a cash cow. They charge more and more each year yet their expenses remain stable. Unlike medical schools, law schools don’t have to pay for expensive lab equipment.

Law schools are now getting into the law firm business and it really is not very helpful. They just add another layer of competition. Since they are able to fund their “firm” through high tuition, they have no profit incentive. They could sell services at a loss. This could have the net effect of killing law firms that could have hired these graduates later. It could drive the cost of law firm salaries down.

I am already seeing the effect of this. The Brooklyn Tech meetup is currently hosted at Brooklyn Law School. A couple of months ago I attended the event. Their legal clinic was giving legal services to start-ups for free. Yes, it is a decent deal for entrepreneurs. Free advice from a law student with help from a professor. Yet, if I were able to nab one of these start-ups, I would be hire these law students and actually pay them for their work. This model simply doesn’t make economic sense for attorneys.

What do you think of Law Schools opening law firms? Is it a good idea to bring legal costs down, or will it further damage the legal industry?

The Law Office of Frederic R. Abramson represents businesses and individuals in New York. If you have a legal question, feel free to contact me at 212-233-0666

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=e5dd0b77-9c00-409c-8541-faa851d1fe72)